LAGRANGE Fund Monitor H1/2023: Institutional Investors Focus on Wider Diversification of Assets Classes and Target Markets when Investing in Real Estate Special AIF – Growing Interest in Secondary Market Transactions

Frankfurt, 25 May 2023 – German institutional investors, while still committed to investing in real

estate and in real estate special AIF, are now planning to expand their real estate portfolio shares at

a slower pace than assumed as recently as late 2022. Meanwhile, there are signs for an increasingly

differentiated selection of eligible asset classes and target markets. Acquiring shares in real estate

special AIF on the secondary market is becoming a more viable alternative to direct investments in

these institutional funds. This is suggested by the findings of the sixth survey for the LAGRANGE Fund

Monitor that LAGRANGE Financial Advisory GmbH and INVESTMENTexpo conducted during the first

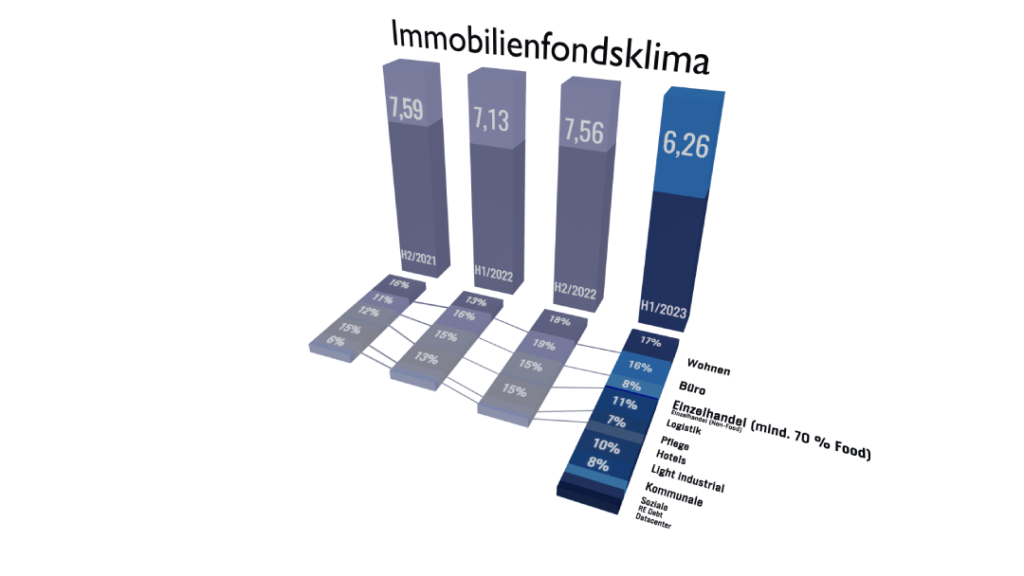

half-year of 2023. With respect to the intended change of their real estate allocation overall, the index

score of 6.12 points, while significantly lower than the score returned by previous polls, was still in the

positive range (H2 2022: 6.96 points). In this context, a score of 1 would signal a drastic reduction

while a score of 11 would imply a drastic increase in the real estate proportion in the portfolio. The

survey showed an analogous drop in the motivation to expand the share of real estate special AIF in

the total special AIF investments, yet it slightly exceeded the interest investors showed in expanding

the real estate ratio in general. Here, the index score came to 6.26 points, down from 7.56 points

during H2 2022.

As far as eligible risk categories go, investors clearly continue to prefer core and core-plus

investments, with relatively minor changes compared to the poll returns during the second half-year

of 2022. Core-plus investments once again topped the list with 44 % (H2 2022: 43 % of the

respondents, with multiple choices possible), followed by core investments, which were named by

33 % of the respondents (H2 2022: 35 %). This means that these two categories again accounted for

Page 2 of 4

more than three quarters of all quoted preferences, whereas value-add investments with 19 % and

opportunistic investments with 5 % remained with a relatively low focus.

By contrast, the preferences among the various real estate sectors experienced much greater shifts.

Choices in this context put residential in the lead with 17 % (H2 2022: 18 %) closely trailed by office—

in late 2022 still the most coveted class—with 16 % (H2 2022: 19 %). Third place was claimed by

logistics with 11 % of the responses (H2 2022: 15 %). Interest in retail with a food share of 70 % or

more, which used to be very much in demand, declined noticeably to just 8 % of the named

preferences (H2 2022: 15 %). While all four of the traditional asset classes suffered either a modest

or noticeable slump in investor interest, two asset classes that used to be considered “niches” moved

closer into the centre of attention. Light industrial is one of them, claiming 10 % of the preferences

(H2 2022: 8 %), just behind logistics. The other represents assets with public-sector tenants like

municipal administrative buildings with alternative use potential (8 %) and health care (senior living)

(7 %), which also generated significantly more interest than before.

Among the target regions for investments via real estate special AIF, Germany retained its lead

position after being named by 17 % of the respondents (H2 2022: 18 %), whereas the ranking of

foreign markets was reshuffled, with several significant shifts in preferences. Named by 13 % of the

respondents, the United States were noticeably more popular than before (H2 2022: 11 %), placing

second overall and as the most interesting foreign market for respondents. Although Austria ascended

to a new peak level after being named by 12 % of the respondents (H2 2022: 11 %), the keen interest

in the United States kept it from advancing past third place, while in turn being closely trailed by

Canada in fourth place with 11 %. Less in demand than it used to be was BeNeLux with 9 % and

specifically the United Kingdom, now down to just 3 %.

The wish to exploit specific opportunities on the real estate markets has become the chief reason for

investing in real estate special AIF lately, being chosen by 37 % of the respondents, whereas 33 %

seek primarily to diversify their portfolio risks. Inflation hedging is quoted by 20 % of the respondents

as their main motive, so that it placed third in the ranking after it had topped the list as recently as the

second half-year of 2022.

The biggest challenge that respondents faced in the context of investing in real estate special AIF t

this time were high property prices and low cap rates, which were named by 37 % (H2 2022: 13 %).

The second-biggest challenge at the moment, quoted by 27 % of the respondents, is financing real

estate investments (H2 2022: 20 %). This contrasts with the risk of falling prices and rents, which

presents a challenge for only 17 % of the respondents anymore (H2 2022: 40 %) and was level with

the challenge of a low supply of appropriate properties (H2 2022: 27 %).

When asked about their inclination to buy shares in real estate special AIF on the secondary market,

respondents returned an average score of 6,51 points, which still represents a clearly positive score

despite its recent decline (H1 2022: 7.13 points). Here, a score of 1 would indicate an absolute lack

of interest whereas a score of 11 would signal a very keen interest. With a score of 6.44 points,

respondents were more interested than ever before in the option to sell shares on the secondary

market (H2/2022: 6.13 points). At the same time, the gap between the number of those interested in

buying and those wishing to sell has visibly narrowed.

In the “current issues” category, participants were asked for their assessments of the probable trend

in inflation rate and interest rate levels as well as of their influence on the respondents’ allocations in

Page 3 of 4

real estate special AIFs, both within the next 12 months and in the medium term. It turns out that

nearly three out of four respondents expect the inflation to slow down considerably in the near future.

Less than one in four believes that the current trend will stay approximately the same, while none

assume that the inflation will keep accelerating. In the medium term, 80 % of the respondents

anticipate average inflation rates between about 2.5 and 5.0 %, whereas those predicting slower or

faster inflation rates were in the minority. Similarly, a clear majority of 80 % expect lending rates to

stay at their current level for the short term, although only 53 % expect as much in the medium term

whereas 40 % anticipate a substantial drop in interest rates.

As far as allocation adjustments due to inflation go, there was virtually no difference between the

short- and medium-term outlook. In either case, roughly two out of five respondents would not rule out

an increase in their real estate special AIF allocations, whereas three out of five are not planning any

changes. Due to the interest rate development, about one fifth of the respondents intend to reduce

their real estate special AIF allocation both in the short and medium term, whereas the level of interest

rates will not influence the allocations of the other four fifths.

“On the whole, institutional investors principally take a bright view of institutional real estate funds,

although a closer look at the preferred asset classes and target markets reveals growing

differentiation. Traditional asset classes have been less in demand than they used to be, whereas

some of the former niche segments, such as light industrial or real estate with public tenants and

alternative use potential, seem to have become more and more attractive lately,” said Dr. Sven

Helmer, Managing Director of Lagrange. “While inflation definitely drives higher real estate allocations,

interest rate changes have clearly less influence on the allocation. Moreover, buying or selling fund

shares on the secondary market is increasingly becoming an alternative to the primary market.” The

polled institutional investors represent mainly segments like insurance companies, banks, pension

funds and pensions schemes.

Company Contact:

Lagrange Financial Advisory GmbH

Monika Bednarz

Executive Director